There’s something quietly empowering about holding a checkbook — that smooth paper symbolizing trust, responsibility, and financial maturity. Maybe you’re paying rent, sending a gift, or settling a bill. Whatever the reason, learning how to write a check correctly is a timeless skill that keeps you in control of your money.

In a world of instant transfers and digital wallets, this simple act still matters — because a well-written check reflects precision, care, and respect. Let’s go through the entire process together, step by step, so you can fill out your next check with confidence.

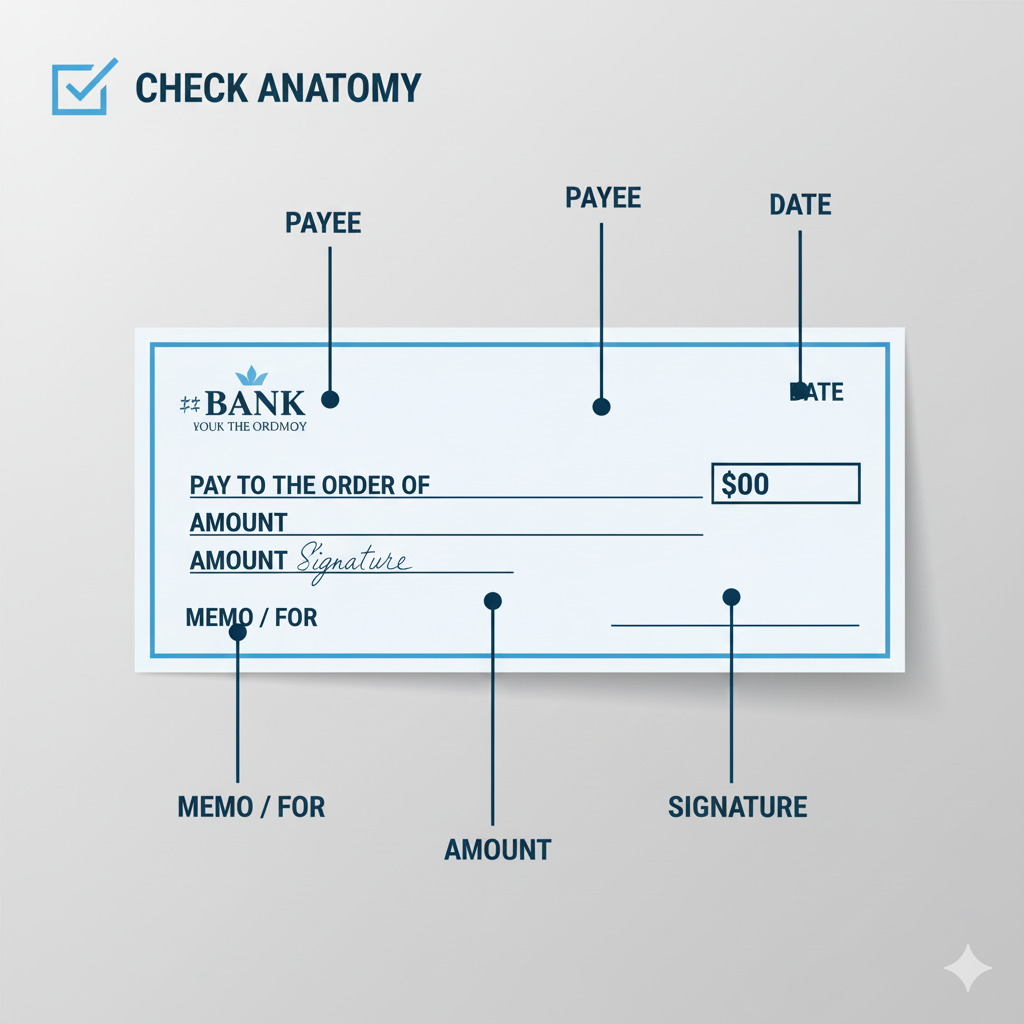

Understanding the Parts of a Check

Before learning how to fill out a check, it helps to know what each part means. Each section on a check plays a vital role in accuracy and security.

The main parts of a check include:

- Date line: when you’re writing the check.

- Payee line: the person or business you’re paying.

- Amount box: the payment in numbers.

- Amount in words line: written form of the amount.

- Memo line: optional note about the purpose.

- Signature line: your authorization.

Knowing these basics makes writing a check simple and ensures it’s accepted without issue.

Step 1: Write the Date on the Check

The date appears in the top right corner. Always write the full date, such as October 19, 2025, to avoid confusion.

Some people “postdate” checks for future payments, but remember — banks can still process them early. Writing the date accurately helps maintain clear financial records.

Step 2: Write the Recipient’s Name (Payee)

On the line that says “Pay to the order of,” write the full name of the person or organization receiving the money.

Example: Pay to the order of: Sarah Johnson or ABC Electric Company.

Avoid using nicknames or incomplete names. Clarity prevents fraud and deposit errors — especially when paying bills or rent.

Step 3: Fill Out the Amount in Numbers

In the small box on the right, write the amount using numbers — for example, $250.75.

Start writing at the far-left edge of the box so no one can add extra numbers. Always include cents — if there are none, write “.00.”

This small detail ensures accuracy and prevents unauthorized alterations.

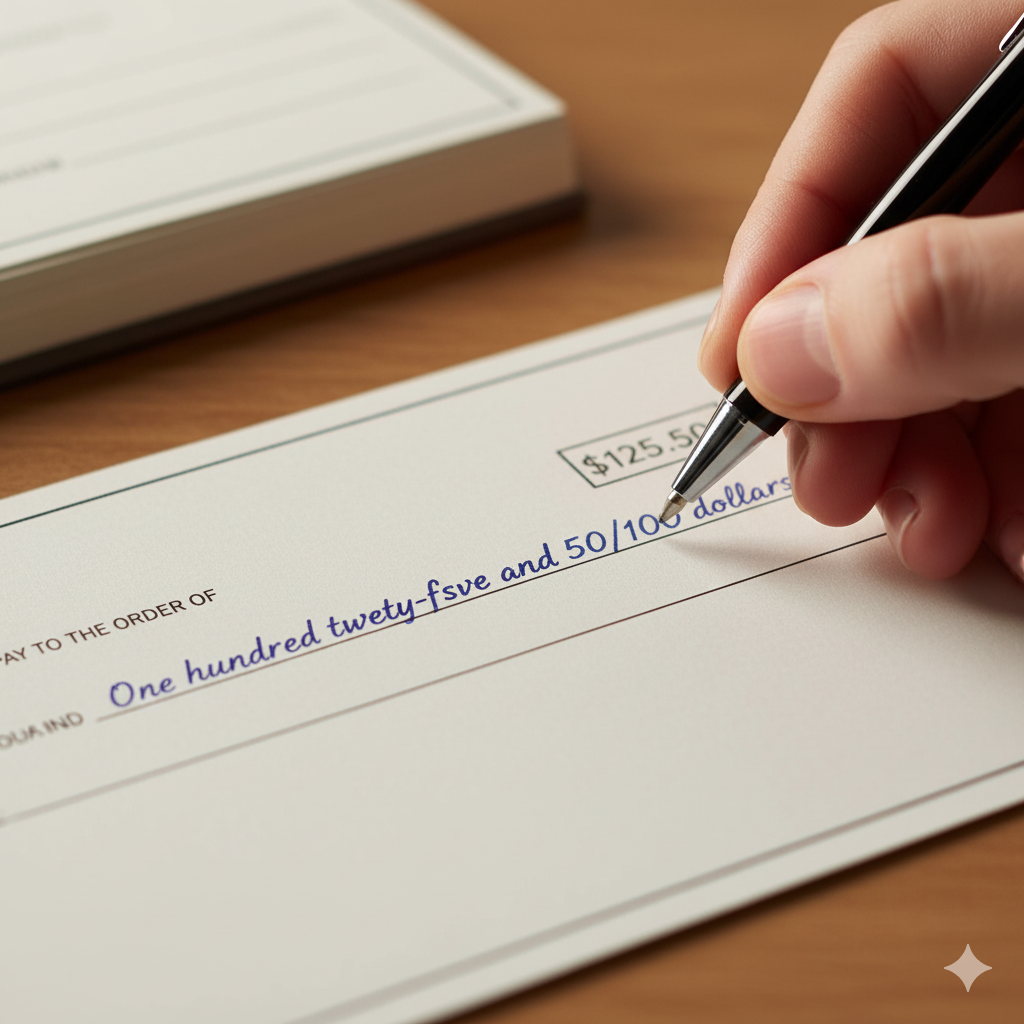

Step 4: Write the Amount in Words

This is one of the most important parts when learning how to write a check correctly. The amount written in words legally overrides the numbers if there’s a discrepancy.

Examples:

- $250.75 → Two hundred fifty and 75/100 dollars

- $80.00 → Eighty and 00/100 dollars

Draw a line through any blank space after the written amount. This prevents anyone from changing it later.

Step 5: Fill in the Memo Line

The memo section is optional but useful for reminders or notes. It helps both you and your payee track payments.

Examples:

- “March Rent”

- “Invoice #1187”

- “Wedding Gift”

Including a memo adds a personal touch and helps with bookkeeping — especially if you write many checks each month.

Step 6: Sign the Check

Your signature makes the check official. Use the same signature your bank has on file. Without it, your check won’t be valid.

If you’re wondering how to write a check for beginners, remember: never sign a blank check. Only sign after every field is filled.

Step 7: Record the Check in Your Checkbook Register

Recordkeeping is a habit that protects your finances. In your check register, note:

- Check number

- Date

- Payee

- Amount

- Purpose

Tracking helps you monitor spending and prevent overdrafts. Financial experts often stress that maintaining your register is a key part of responsible money management.

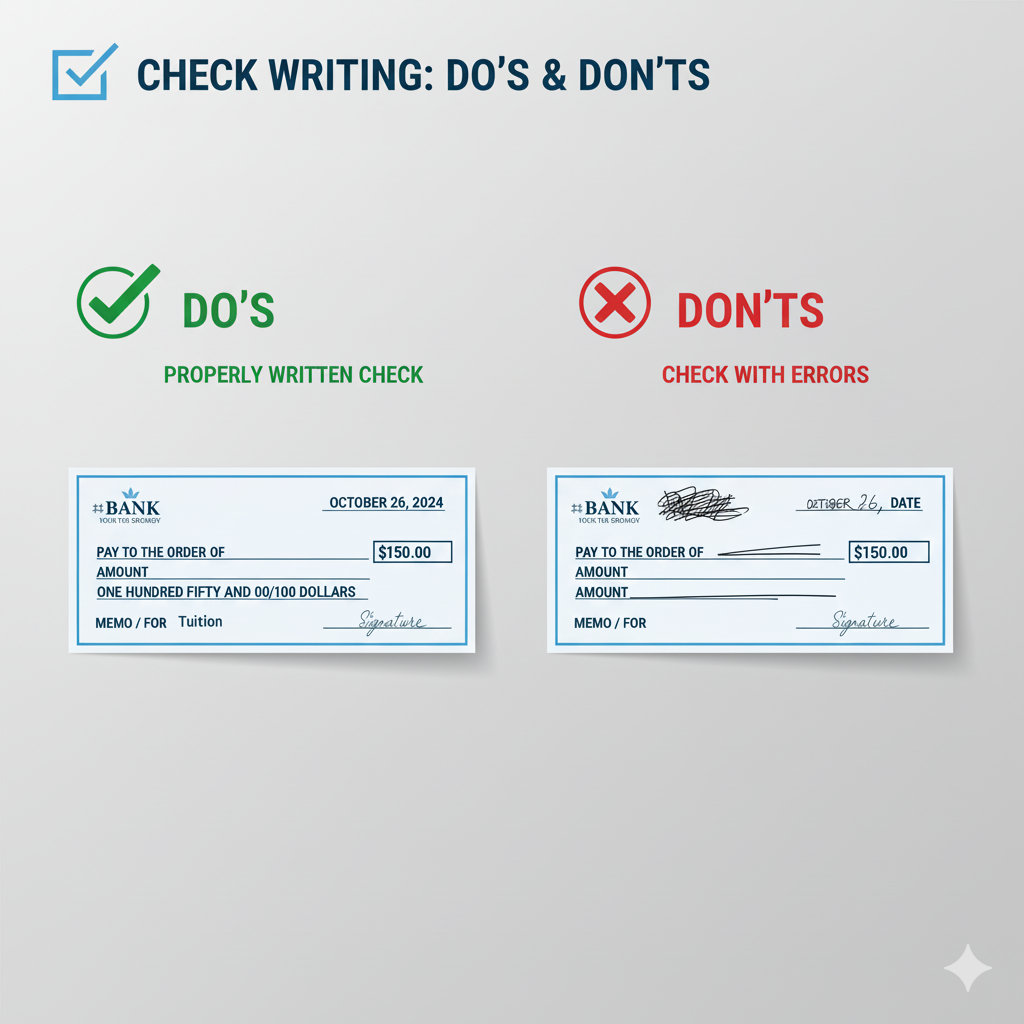

Common Mistakes to Avoid When Writing a Check

When learning how to write a check step by step, it’s easy to make small errors. Avoid these common ones:

❌ Leaving blank lines or spaces

❌ Forgetting to sign or date

❌ Writing mismatched numbers and words

❌ Using pencil or erasable ink

❌ Writing illegibly

A quick check before signing prevents rejection or fraud.

Real-Life Example: Writing a Rent Check

Imagine paying your landlord $850 for November rent. Here’s what your completed check should look like:

- Date: October 25, 2025

- Payee: John Davis

- Amount (numbers): $850.00

- Amount (words): Eight hundred fifty and 00/100 dollars

- Memo: November Rent

- Signature: Your full name

That’s it — you’ve just written a perfect check!

How to Write a Check for Cents Only

If you ever need to write a check for cents only (like 45¢), write:

Zero and 45/100 dollars.

It’s uncommon, but it keeps your check accurate and legally valid.

How to Write a Voided Check

If you make an error or need to cancel a check, write “VOID” in large, bold letters across the front.

This prevents it from being used fraudulently. You can still give a voided check to your employer or bank to set up direct deposit or automatic payments.

Paper Checks vs. Digital Payments

Modern banking has introduced digital check writing, where you fill out details online and your bank sends the payment.

Digital checks are faster and safer, but knowing how to write a paper check remains essential — especially for rent, formal payments, or older institutions.

Understanding both methods makes you financially versatile.

Check Writing Tips for Security

✔ Use permanent blue or black ink.

✔ Never leave blank lines or spaces.

✔ Keep your checkbook in a safe place.

✔ Verify cleared checks in your statements.

✔ Report lost or stolen checks immediately.

Small habits like these protect you from fraud and financial loss.

FAQs About How to Write a Check

Q1: Can I write a check without cents?

Yes. Simply write “and 00/100 dollars” after the written amount.

Q2: What happens if I make a mistake?

If it’s small, cross it out neatly and initial beside it. For big mistakes, void the check and start fresh.

Q3: How do I write a check for cash?

Write “Cash” on the payee line, but use this carefully — anyone can cash it.

Q4: How long does it take for a check to clear?

Most checks clear in 1–3 business days, depending on your bank.

Q5: Can I write a postdated check?

Yes, but some banks may still process it early. Communicate with your payee first.

Q6: How do I write a check for cents only?

Write “Zero and XX/100 dollars.” Example: “Zero and 45/100 dollars.”

Q7: What’s the safest way to mail a check?

Seal it securely, avoid marking “check” on the envelope, and mail it through a secure drop box.

Conclusion: Confidence in Every Signature

Knowing how to write a check may seem old-fashioned, but it’s a skill that shows maturity, precision, and care. Each line you fill reflects integrity — a quiet confidence in handling your own finances.

Whether you’re paying rent, writing a donation, or gifting money to a loved one, the way you write a check says something about your responsibility and trustworthiness.

Take pride in doing it right — it’s more than paper; it’s proof of reliability.